Advisors can help clients achieve stability and security

A recent generational study shows how deeply American consumers have experienced a financial impact from COVID-19.

For the study, about 1,200 adults age 18 and up participated in an online survey conducted in June by North American Company for Life and Health Insurance. North American released “COVID-19 and Your Retirement” in October.

Feeling the financial impact from COVID-19

According to the survey, one-third of participants said they changed how they think about investing. In addition, they started taking a more aggressive approach. Here’s the breakdown by generation:

- Gen X: 43%

- Millennials: 37%

- Baby Boomers: 35%

- Gen Z: 33%

What’s more, 50% of survey respondents said the coronavirus affected how they handle their money and save for retirement – and younger generations reported they felt the most significant financial impact from COVID-19.

Consumers, in their own words

Some survey participants shared personal anecdotes about how the pandemic has affected their investment plans and retirement savings strategies. A number suffered income cuts due to job losses, while others stopped saving or drew from their savings to pay bills.

Furthermore, several respondents said market volatility reduced the value of their stocks or retirement accounts. Also, many noted they had cut back on discretionary spending and were purchasing only essential items.

Perception of annuities

Some consumers are weighing whether to purchase annuities to guard against the financial impact of COVID-19 market fluctuations. Because annuities are complex financial instruments, North American pared down the definition for its survey audience as follows:

Some retirement financial products allow you to contribute a set periodic amount or lump sum. Then, your money grows tax-deferred with an option to receive guaranteed payments throughout your retirement, regardless of how the stock market does. It may not have as high returns as a stock account, but you are also guaranteed not to lose money due to market losses.

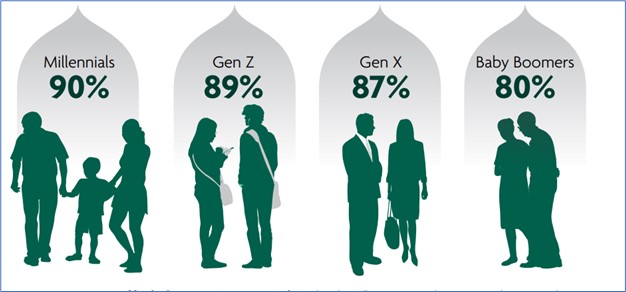

About 83% of survey respondents overall indicated an interest in annuity products. Yet as the graphic below shows, the younger generations expressed a greater degree of interest than the older ones.

Source: North American Company for Life and Health Insurance

Improving people’s lives

It’s highly likely there are many folks who live in your community facing the same challenges as those in the North American survey.

As a financial advisor, you have the specialized knowledge and experience to help people make informed decisions. In fact, with an advisor’s assistance, they may be able to offset the financial impact from COVID-19 and better position themselves for long-term financial security.

LeadingResponse can work with you to identify and reach out to individuals and families who can benefit from your financial planning expertise – and grow your business at the same time. Learn more about how we connect advisors with clients to boost revenue.