Listen to this Article

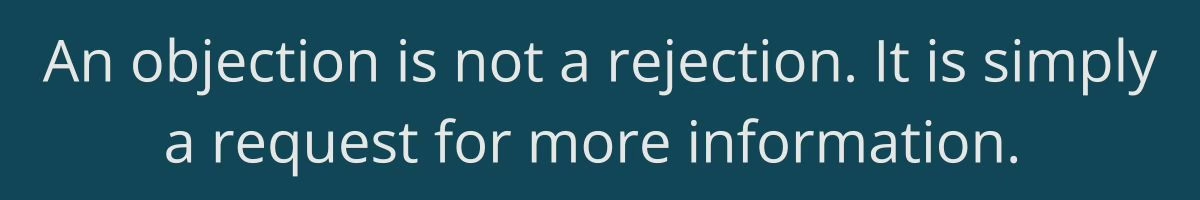

Objection handling is a critical skill for financial advisors aiming to grow their client base and establish trust. Every financial advisor has encountered moments when a promising conversation takes a turn due to client objections. These objections, ranging from concerns about fees to skepticism about advice, can feel like roadblocks. But they’re actually opportunities to build credibility, address concerns, and deepen relationships.

In this guide, we’ll explore the most common objections financial advisors face, effective objection-handling techniques, and actionable steps to overcome objections. By mastering these strategies, you can turn resistance into resolutions and close more business.

Understanding Common Objections

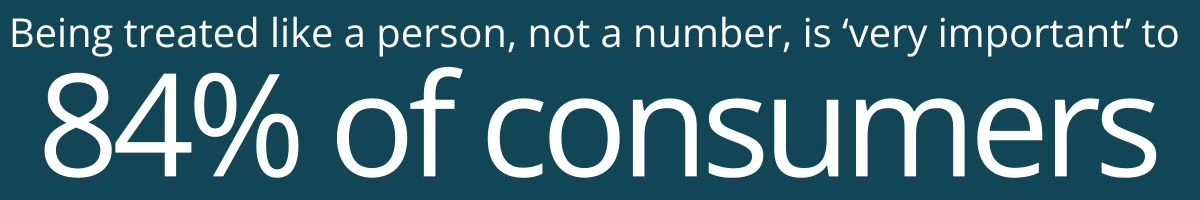

Objections are a natural part of any sales conversation, and understanding them is the first step toward overcoming them. By identifying the underlying concerns behind common objections, financial advisors can better prepare to address client hesitations effectively. This section outlines the objections you’re most likely to encounter and sheds light on the deeper issues they reveal.

- Cost Concerns

- Objection: “Your fees are too high.”

- Underlying Issue: Clients may not see the value of your services or may compare your fees to less comprehensive options.

Cost concerns often stem from a lack of understanding about the unique benefits you provide. It’s essential to communicate the tangible and intangible value of your expertise. For instance, emphasize the long-term savings, financial growth, and peace of mind that professional advice offers. By reframing the conversation around value rather than cost, you can help clients see your services as an investment rather than an expense.

- Skepticism About Advice

- Objection: “I’m not sure I trust financial advisors.”

- Underlying Issue: Past negative experiences or industry stereotypes can make clients wary.

Skepticism is often rooted in a fear of being misled or poorly advised. Addressing this requires transparency and empathy. Share your qualifications, fiduciary responsibility, and examples of successful outcomes with other clients. Building trust through honest communication can alleviate these fears and create a foundation for a strong advisor-client relationship.

- Timing

- Objection: “This isn’t the right time for me to invest.”

- Underlying Issue: Clients may feel uncertain about the economy or their own financial situation.

Timing objections often reflect a fear of risk or uncertainty. By acknowledging these concerns and demonstrating how proactive financial planning can mitigate risks, you can reassure clients. Use data to illustrate the benefits of starting early and how even small steps today can lead to significant progress in the future.

- Lack of Understanding

- Objection: “I don’t see how this plan helps me.”

- Underlying Issue: Clients may not fully grasp how your advice aligns with their goals.

Clarity and education are key to overcoming this objection. Break down your recommendations into simple, relatable terms. Show clients how your plan aligns with their personal objectives and use visuals or real-world examples to illustrate the benefits.

- Do-It-Yourself Mentality

- Objection: “I can manage my finances myself.”

- Underlying Issue: Confidence in their ability or a belief that professional help isn’t worth the investment.

While DIY approaches can work for some, many clients underestimate the complexity of comprehensive financial planning. Highlight the time, expertise, and resources you bring to the table. Share examples of how professional advice has helped others avoid costly mistakes or achieve goals more efficiently.

Objection Handling Techniques

Once you understand the common objections, the next step is learning how to address them effectively. Handling objections isn’t about forcing a client to agree but about guiding them through their concerns with empathy and logic. The following techniques provide actionable strategies to navigate even the most challenging objections.

1. Active Listening

One of the most critical aspects of handling objections is listening—not just to respond but to understand. Active listening involves:

- Maintaining eye contact (in person or via video).

- Nodding or using affirmations like “I understand” or “That makes sense.”

- Paraphrasing the client’s concern to show understanding.

For example, if a client says, “Your fees seem high,” you might respond, “It sounds like you’re concerned about whether my services justify the cost. Let’s explore that together.”

Active listening builds trust by making clients feel valued and heard. When clients feel their concerns are acknowledged, they’re more open to considering solutions. Demonstrating empathy and understanding lays the foundation for a productive conversation, making clients less defensive and more receptive.

2. Ask Open-Ended Questions

Open-ended questions are a powerful way to uncover the root cause of an objection. Instead of assuming you know why a client hesitates, ask questions that invite them to share their perspective. For instance:

- Client: “I’m not ready to make a decision now.”

- Advisor: “Can you share what’s holding you back? Is it timing, concerns about the plan, or something else?”

Instead of assuming the reasons behind an objection, ask open-ended questions that encourage clients to share their thoughts. For example, “What specifically about the timing is concerning you?”

Open-ended questions reveal the underlying issues behind objections, providing clarity and direction for addressing them. They help uncover specific concerns, allowing you to tailor your responses effectively.

3. Empathize and Acknowledge

Clients want to feel heard. Acknowledge their concerns without immediately trying to counter them. For example:

- Client: “I’ve heard horror stories about financial advisors.”

- Advisor: “I completely understand why you might feel that way. Unfortunately, there are bad actors in every industry, and it’s disappointing when clients have those experiences.”

Acknowledging a client’s concerns shows that you respect their perspective. Empathy demonstrates that you care about the client’s feelings and aren’t just focused on closing the sale. Validating concerns reduces resistance and opens the door for constructive dialogue. Plus, clients appreciate genuine care and are more likely to see you as a trusted advisor.

Take the Next Step Toward Business Growth

One of the best ways to avoid objection is to meet with highly qualified, motivated prospects. LeadingResponse’s expert marketing consultants are here to help you streamline your intake process and maximize your sales funnel.

Objection Handling Techniques

Once you understand the common objections, the next step is learning how to address them effectively. Handling objections isn’t about forcing a client to agree but about guiding them through their concerns with empathy and logic. The following techniques provide actionable strategies to navigate even the most challenging objections.

1. Active Listening

One of the most critical aspects of handling objections is listening—not just to respond but to understand. Active listening involves:

- Maintaining eye contact (in person or via video).

- Nodding or using affirmations like “I understand” or “That makes sense.”

- Paraphrasing the client’s concern to show understanding.

For example, if a client says, “Your fees seem high,” you might respond, “It sounds like you’re concerned about whether my services justify the cost. Let’s explore that together.”

Active listening builds trust by making clients feel valued and heard. When clients feel their concerns are acknowledged, they’re more open to considering solutions. Demonstrating empathy and understanding lays the foundation for a productive conversation, making clients less defensive and more receptive.

2. Ask Open-Ended Questions

Open-ended questions are a powerful way to uncover the root cause of an objection. Instead of assuming you know why a client hesitates, ask questions that invite them to share their perspective. For instance:

- Client: “I’m not ready to make a decision now.”

- Advisor: “Can you share what’s holding you back? Is it timing, concerns about the plan, or something else?”

Instead of assuming the reasons behind an objection, ask open-ended questions that encourage clients to share their thoughts. For example, “What specifically about the timing is concerning you?”

Open-ended questions reveal the underlying issues behind objections, providing clarity and direction for addressing them. They help uncover specific concerns, allowing you to tailor your responses effectively.

3. Empathize and Acknowledge

Clients want to feel heard. Acknowledge their concerns without immediately trying to counter them. For example:

- Client: “I’ve heard horror stories about financial advisors.”

- Advisor: “I completely understand why you might feel that way. Unfortunately, there are bad actors in every industry, and it’s disappointing when clients have those experiences.”

Acknowledging a client’s concerns shows that you respect their perspective. Empathy demonstrates that you care about the client’s feelings and aren’t just focused on closing the sale. Validating concerns reduces resistance and opens the door for constructive dialogue. Plus, clients appreciate genuine care and are more likely to see you as a trusted advisor.

4. Reframe the Objection

Reframing helps clients see their concerns in a new light. For example:

- Client: “Your fees are too high.”

- Advisor: “I understand that fees are an important consideration. Many of my clients initially felt the same way but later saw the long-term value in tailored financial strategies. Let me show you how my approach could save or grow your wealth significantly over time.”

Help clients view their concerns from a new perspective. Reframing shifts the focus from the objection to the benefits of your services. It encourages clients to reconsider their stance and see the bigger picture, as well as the value of your services.

5. Provide Evidence and Social Proof

Clients often need assurance that your advice works. Use:

- Case studies or success stories.

- Testimonials from satisfied clients.

- Data to support your claims (e.g., investment performance).

Share testimonials, success stories, or data that support your claims. For example, “Clients who followed this strategy have seen an average increase in their savings by 20%.” Evidence reinforces your credibility and assures clients that your advice works. It provides tangible proof that can alleviate doubts and build confidence.

6. Address Concerns Directly

Avoid skirting around objections. Instead, tackle them head-on with honesty and transparency. For example, break down your fee structure to show its alignment with the value provided. Directly addressing concerns shows integrity and builds trust. Clients appreciate transparency and are more likely to feel comfortable moving forward.

7. Offer Choices

Presenting options can help clients feel more in control of their decisions. For instance:

- “Would you feel more comfortable starting with a smaller investment to see how the process works?”

- “We can customize the plan to fit your current needs while keeping long-term goals in mind.”

Giving clients options empowers them to make decisions that feel right for their situation. Presenting options reduces pressure and builds confidence in the decision-making process. Clients feel more in control and less hesitant about committing.

Steps to Overcome Objections

Effectively overcoming objections requires a systematic approach. Each step builds on the last to guide clients toward a resolution. In this section, we outline a clear framework to address concerns and build confidence in your services.

Step 1: Prepare Thoroughly

Preparation is the foundation of successful objection handling. By anticipating potential concerns and having thoughtful responses ready, you can approach conversations with confidence. Preparation includes:

- Reviewing common objections and crafting responses.

- Keeping updated on industry trends and competitor offerings.

- Practicing objection handling techniques through role-play.

Step 2: Build Trust Early

Trust is the foundation of successful objection handling. Build trust by:

- Being transparent about your fees and processes.

- Sharing your qualifications and certifications.

- Highlighting your fiduciary responsibility.

Step 3: Understand the Objection

Clarify the client’s concern. Avoid assuming you know what they mean. Use phrases like:

- “Can you elaborate on that?”

- “What specific aspect worries you?”

Step 4: Respond with Value

Tie your response to the client’s goals. For instance:

- “I understand that you’re hesitant to invest now. Let’s look at how starting today could position you for a stronger retirement.”

Step 5: Close the Loop

After addressing the objection, confirm that the client’s concern has been resolved. Ask:

- “Does that address your concern?”

- “Is there anything else you’d like to discuss?”

By systematically addressing objections, you demonstrate professionalism and a commitment to meeting client needs.

Tips for Closing More Business

Closing a sale is the ultimate goal, but it’s also the most delicate part of the process. By guiding clients through their objections and offering reassurance, you can confidently move toward a close. This section highlights techniques to encourage clients to take action while reinforcing the value of your services.

- Use the Assumptive Close

Act as though the client has already decided to move forward. For example:

- “Shall we schedule our first review meeting for next month?”

- Highlight Urgency

Encourage clients to act by emphasizing time-sensitive opportunities:

- “Starting now allows us to take advantage of this year’s tax strategies.”

- Revisit Goals

Remind clients of their objectives and how your services align:

- “Your goal is to retire at 60 with a steady income. This plan ensures we’re on track to achieve that.”

- Be Patient but Persistent

Not all clients will immediately commit. Follow up respectfully, providing additional resources or addressing lingering concerns. Persistence shows dedication and keeps you top of mind without pressuring the client.

- Ask for the Commitment

When the timing feels right, confidently ask for the next step:

- “Are you ready to move forward with this plan?”

- “Let’s start putting this strategy into action—how does that sound?”

By balancing urgency with reassurance, you can close more business while maintaining trust and rapport.

Ready to Learn More? Get the Full Report

Are you ready to see your full potential? Get your step-by-step guide to connect, engage, and turn more prospects into clients. This free download outlines the top 7 steps, proven by years of experience and science, to help you build relationships and help motivate prospects to turn into clients.

Conclusion: Building Confidence Through Objection Handling

Objection handling is more than a sales skill—it’s an opportunity to build trust, demonstrate value, and foster long-term client relationships. By understanding common objections, actively listening, and employing proven techniques, you position yourself as a trusted advisor who truly cares about client success.

Reframing objections helps shift perspectives, allowing clients to see the benefits of your services clearly. Addressing concerns directly and transparently builds confidence, while providing evidence and options reinforces your credibility. Together, these strategies help you not only close deals but also create lasting partnerships.

When handled effectively, objections become stepping stones to deeper connections and stronger relationships. By mastering the art of objection handling, you ensure your clients feel understood, valued, and confident in choosing you as their financial advisor.