Listen to this Article

Generation Z, born between 1997 and 2007, is stepping into adulthood with a world of opportunity at their fingertips. But when it comes to personal finance, they face a growing challenge: building emergency savings.

While this generation is often praised for its digital fluency and social awareness, recent data paints a concerning picture of Gen Z financial habits. Many young adults are financially unprepared to handle even minor emergencies, creating serious risks for their long-term stability. For financial advisors, this reality presents both a call to action and a unique opportunity to support and guide the next wave of earners and investors.

Gen Z Savings Statistics 2025: A Wake-Up Call

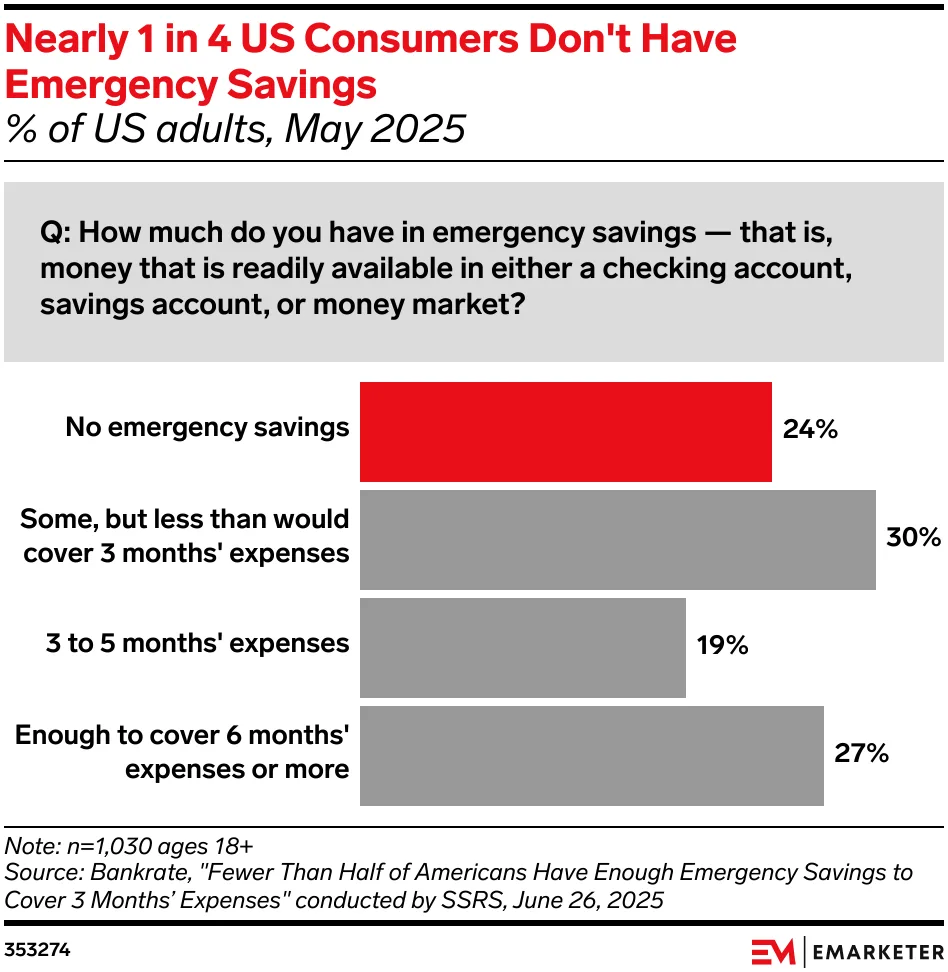

According to Bankrate’s 2025 Emergency Savings Report, Gen Z (ages 18 to 28) is the most likely generation to lack sufficient emergency savings. The findings reveal:

- 34% of Gen Zers have no emergency savings at all

- 37% have less than three months’ worth of savings

- Only 29% feel comfortable with their current savings level

For comparison, only 16% of baby boomers report having no savings, and over half (52%) feel comfortable with their current emergency funds. Even millennials and Gen Xers outperform Gen Z in this area, highlighting a generational gap in preparedness.

These Gen Z savings statistics for 2025 suggest that while older generations may have had more time and perhaps different economic environments, younger adults are struggling to prioritize financial safety nets.

Understanding Gen Z Financial Habits

It’s not just about income or access. Gen Z financial habits reflect a mindset focused more on present enjoyment than future planning. According to a recent Credit Karma study:

- 49% of Gen Zers say planning for the future feels pointless

- 37% expect to spend more on dining out, entertainment, and travel this summer

- 32% plan to focus on their finances only after summer ends

In short, Gen Z is living in the moment. They value experiences, flexibility, and lifestyle choices that may conflict with traditional ideas of saving. Many aren’t ignoring money; they just don’t view saving as an urgent need.

This shift in priorities doesn’t mean Gen Z can’t be reached, it simply means the message needs to change. That’s where financial advisors come in.

Why Financial Advisors and Gen Z Need to Connect

Reaching Gen Z isn’t just good business. It’s essential for the future of financial planning. By establishing trust early, advisors can help this generation form healthier money habits, build emergency funds, and grow their wealth over time.

Advisors who learn how to connect with Gen Z can position themselves as long-term partners in their financial journey. This isn’t just about getting clients in the door; it’s about creating lifelong relationships that start with foundational steps like budgeting and saving.

Early financial guidance makes a real difference. Helping someone build an emergency fund at 22 sets them up for better decision-making at 32. And that kind of support can lead to increased loyalty and referrals down the line.

Emergency Savings for Young Adults: Why It Matters

Emergency savings serve as a financial cushion that protects individuals from unexpected expenses like medical bills, car repairs, or job loss. For young adults, having even a small emergency fund can help prevent debt, reduce financial stress, and support long-term goals, such as homeownership or investing.

Without this safety net, Gen Z may turn to credit cards, loans, or family support, which can delay their independence and financial stability. Advisors play a key role in changing that narrative by showing young clients how emergency savings fit into a broader plan.

How to Encourage Gen Z Financial Planning

To improve Gen Z financial planning outcomes, advisors need to meet them where they are, both in mindset and medium. Here are five effective strategies:

- Keep It Digital-First

Gen Z grew up with smartphones and social media. To reach them, advisors should use video content, mobile apps, social media posts, and email newsletters. Simplified tools and mobile access are key.

- Focus on Purpose, Not Pressure

Rather than emphasizing fear or risk, tie financial goals to personal values. Want to travel? Demonstrate how saving a little now can help support that dream. Saving for freedom or flexibility often resonates more than saving “just in case.”

- Promote Micro Goals

Gen Z responds well to small, achievable goals. Instead of telling them to save three months of expenses, start with $100. Use automated savings apps or challenges that make it easy to see progress.

- Use Real-Life Scenarios

Instead of vague warnings, share relatable stories. For example, “Having $500 saved helped a client avoid credit card debt when their car broke down.” Stories humanize saving.

- Offer Flexible, Judgment-Free Guidance

Young adults often feel overwhelmed or judged when discussing money. Create a safe, welcoming space for them to ask questions, explore options, and make mistakes without shame.

Building Trust Through Education and Transparency

Trust is everything when working with Gen Z. Advisors who focus on transparency, clear explanations, and low-pressure conversations will earn their respect. Educational resources, especially those that are free, digital, and interactive, can help build that trust even before a formal relationship begins.

Consider offering:

- A downloadable emergency savings worksheet

- A short video on “What Is a Financial Safety Net?”

- A budgeting tool tailored for Gen Z incomes

These resources offer immediate value and pave the way for more in-depth conversations.

Want to Start Reaching Gen Z and Other Prospects?

Let’s talk about how to attract, engage, and guide the next generation of clients with tools and strategies that work.

A Generation Worth Investing In

While Gen Z may seem reluctant to plan, it’s more accurate to say they want to plan on their own terms. Financial advisors who adapt to Gen Z financial habits will not only help young adults build better futures but also position themselves for long-term growth.

Now is the time to act. The Gen Z savings statistics from 2025 serve as a wake-up call, but they also highlight a significant opportunity: to guide, educate, and empower a generation that’s just getting started.

Help Gen Z take that first step—and they may stay with you for every step after.