Listen to this Article

As a financial advisor, you are likely always looking for new ways to broaden your client base and diversify your portfolio of services. One of the most promising groups to target is women.

Despite being a historically underrepresented demographic in the investment world, women are proving themselves to be excellent investors. In fact, research and real-world examples show that women often outperform men in the stock market and exhibit stronger financial habits. Below, we’ll dive into five key reasons why women make better investors and why you should actively seek out more women clients.

1. Women are Better at Risk Management

One of the most important skills for any investor is the ability to manage risk, and women tend to excel in this area. Numerous studies have shown that women approach investing with a more cautious and strategic mindset. For instance, research by the Warwick Business School found that women tend to make less risky investment choices than men, which results in better long-term returns. By avoiding impulsive, high-risk decisions, women are able to weather market volatility and are less likely to panic during downturns.

Women also tend to hold investments for a longer period of time, focusing on stable, well-researched options rather than chasing short-term gains. This disciplined approach often leads to a more balanced, diversified portfolio. And one that is built to succeed over time, regardless of market fluctuations.

As a financial advisor offering financial planning for women, you can emphasize strategies that are built to minimize risk and help women achieve their goals with confidence.

2. Long-Term Planning is a Priority

While men are often more focused on quick gains, women tend to prioritize long-term financial stability. Women’s investment strategies are typically grounded in clear financial goals, like saving for retirement or paying for their children’s education. This focus on long-term planning is crucial for successful investing. It helps clients avoid getting sidetracked by short-term market trends or the latest investment fads.

Studies show that women investors are more likely to stay the course during tough market periods and are less likely to sell their assets impulsively. A report from the Boston Consulting Group highlighted that women investors are 30% more likely to say they have a clear financial plan than their male counterparts. This disciplined approach is critical for building wealth over time and achieving financial independence, particularly when it comes to retirement planning for women.

By offering personalized women’s financial advice that emphasizes long-term stability, you can help your female clients achieve the security they desire for the future.

3. Women Are Less Likely to Churn Investments

A study by the investment firm Fidelity found that women are more likely to keep their investments for a longer period of time, leading to higher returns. This “buy and hold” strategy contrasts with men, who tend to buy and sell investments more frequently. Trading often leads to higher fees and taxes, which can erode overall returns. In contrast, women’s tendency to stay the course and hold their investments is one of the factors contributing to their outperformance in many markets.

By focusing on long-term, stable investments, women have a lower tendency to churn their portfolios. As a financial advisor, this behavior can work to your advantage. This means fewer trade transactions and a greater opportunity for building long-term relationships with your clients. Clients who trust their financial advisors and are invested in their future will likely remain loyal over time.

Targeting financial advisors for women can help you connect with clients who value stability, transparency, and trust.

4. Women Are More Likely to Seek Professional Advice

Research has shown that women are more likely to seek financial advice than men. This positions them as ideal clients for financial advisors. A 2024 report from Bank of America found that nearly half of women wanted to work with a financial advisor, but only 28% felt empowered to take action on it. This represents a tremendous opportunity for financial advisors to step in and provide guidance to an underserved market.

Women recognize the value of expert financial advice. And they are often more open to working with advisors who can help them meet their financial goals. By targeting women clients and offering comprehensive financial planning for women, you can establish yourself as a trusted advisor who understands their unique needs and is committed to helping them achieve their financial aspirations.

5. Women Tend to Be More Conservative Savers

Research shows that women tend to be more conservative savers. They prioritize stability and security in their financial planning. While women may save less than men in areas like retirement savings, many are proactive about maintaining emergency funds and protecting themselves financially. Studies from GOBankingRates show that women often focus on practical financial goals, such as saving for unexpected expenses. Although they may save at a slower pace than men, they are careful and deliberate with their money. In a 2024 survey, 57% of women reported having money saved for an emergency, compared to 44% of men.

This conservative saving approach means that women also take more thoughtful steps when building wealth. While they may not pursue high-risk investments as often as men, they are typically more focused on long-term goals. This strategy can lead to greater financial security and stability over time.

As a financial advisor, recognizing these tendencies can help you guide your female clients in creating strong savings plans. Tailor these plans to their conservative approach, while encouraging smarter, more strategic investments. In retirement planning for women, focusing on long-term stability is key.

Women tend to prefer a cautious approach to investing, but with the right guidance, you can help them build a robust retirement plan. This ensures financial independence in their later years. By addressing their unique needs and offering customized strategies, you can empower them to protect their future and enhance their retirement savings.

Why You Should Seek More Women Clients

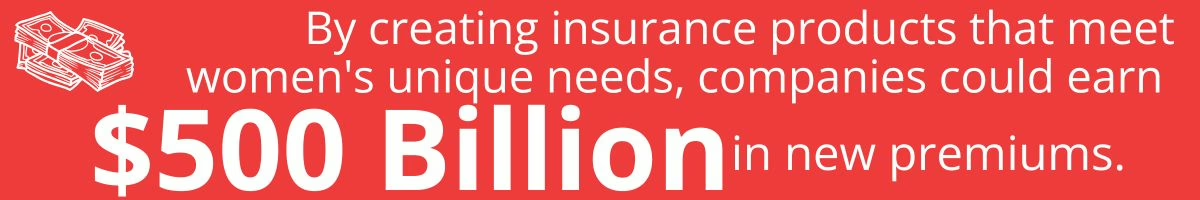

The financial landscape is evolving, and women are increasingly becoming an influential part of this shift. In fact, women are projected to control a significant portion of wealth in the coming decades.

According to a study by McKinsey & Company, women are expected to inherit $30 trillion in assets by 2030. This means that women will soon be making even more decisions about where to invest their money. As a financial advisor, it’s essential to tap into this growing market.

By understanding the unique strengths women bring to the table, you can better tailor your services to meet their needs. Women investors tend to be loyal, consistent, and committed to financial planning, which can lead to long-term client relationships. Moreover, more women seek professional advice and play a larger role in the wealth management industry. There is an incredible opportunity for financial advisors to engage with a new, untapped market.

Expand Your Reach: Engage and Empower Women Investors

Looking to grow your portfolio by connecting with women investors? Our proven financial seminar strategies help you engage this key audience with tailored insights and solutions. Click below to discover how seminars can transform your outreach and build lasting client relationships.

Final Thoughts

Women make exceptional investors. Financial advisors should recognize the value of seeking out more women clients. Women tend to focus on long-term planning, risk management, and discipline, which can provide strong foundations for financial growth. By understanding and respecting this unique approach to investing, you can enhance your services and build stronger, more trusting relationships with your female clients.

With more women entering the wealth-building space, now is the perfect time to embrace this opportunity. By tailoring your financial strategies to meet their needs, you can create a lasting impact and attract a loyal client base.

As a financial advisor, your goal is to offer the best possible advice, regardless of gender. Understanding how women approach investing and recognizing the strengths they bring to the table will help you build stronger connections with your female clients. Don’t miss out on this growing demographic and the opportunity to set yourself up for future success.