Listen to this Article

Women are shaping the financial world like never before. From spearheading major investments to making up a growing share of household decision-makers, women are a powerful and often underrepresented force in finance. For financial advisors, this presents an enormous opportunity—not just to grow your client base but to truly meet the unique needs of an underserved market. By focusing on women in finance, you can foster stronger client relationships, drive greater long-term loyalty, and position your practice as a leader in inclusive financial planning.

The Rising Influence of Women in Finance

Women are playing an increasingly vital role in shaping financial markets. Consider these trends:

- Wealth Ownership: Women are expected to control $34 trillion in wealth by 2030 in the U.S. alone, driven by intergenerational transfers and growing incomes.

- Decision-Making Power: Women are the primary financial decision-makers in 85% of households.

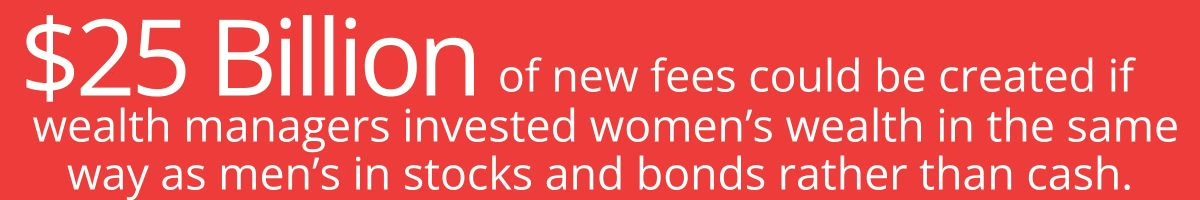

- Investment Behavior: Women are more likely than men to invest with a long-term, socially conscious approach. That’s an influx of $1.87 trillion in additional capital if women invest at the same rate as men.

Yet despite their influence, women often face unique challenges when it comes to financial planning for women. The persistent gender pay gap to longer life expectancies that demand greater retirement savings. Advisors who understand and address these needs can set themselves apart in a competitive market.

The Challenges Women Face

It’s no secret that gender roles have had a significant impact on women’s relationships with money. Before 1974, women needed a male co-signer to access bank accounts or open a line of credit. When it came to the workplace, women could legally be fired for being pregnant until the Pregnancy Discrimination Act took effect in 1978. Since then, women have made great strides toward financial literacy and independence, but we still have a long way to go.

1. The Wealth Gap

Women earn less than men on average, earning just 84 cents for every dollar a man makes. Additionally, women more often take time out of the workforce for caregiving, which can limit career advancement and savings. On average, 24% of women exit the workforce in their first year of motherhood. And that caregiving isn’t restricted to children. Women are responsible for most informal care for parents, spouses, friends, and neighbors.

2. Caregiving

An estimated 66% of U.S. caregivers are women, providing the backbone of this unpaid service. The value of informal care that women provide ranges from $148-188 billion annually. As a result, women tend to have smaller retirement accounts and less accumulated wealth. The negative impact of a caregiver retirement account is estimated at roughly $40,000 more for women than it is for men. Part of this could be because, according to a recent study, 16% of women quit their jobs, and 13% retired early due to their caregiving responsibilities.

3. Financial Confidence

Studies show that women are less likely than men to feel confident about making financial decisions, even when their knowledge is comparable. A Bank of America study found that 48% of women are confident about their finances, though only 28% feel empowered to act. Their top financial regrets are not investing and saving money sooner in life.

However, 53% of men feel confident in their finances and are more likely to have a variety of investing vehicles, such as a brokerage account, annuity, or pensions. This gap can prevent women from seeking advice or pursuing investment opportunities. This means there is a need for tailored financial planning for women to bridge this confidence gap.

4. Longevity and Healthcare Costs

Women typically live longer than men, often outliving their spouses, and have less access to retirement savings and pensions. In 2015, 48% of women 75 and older were living alone, compared to just 22% of men the same age. Because of women’s longer life expectancy and lower incomes, more savings are required to maintain their quality of life in retirement.

They are also more likely to face significant healthcare expenses. Women spend 20% more on out-of-pocket health costs than men – that’s a total of $15.4 billion more. Only 2% of this is due to maternity costs. The “pink tax”, and lower actuarial values (meaning insurance covers less of women’s health claims than men’s) seem to both be responsible.

Women face unique financial challenges highlighting the critical need for personalized financial planning and guidance. Financial advisors are vital in bridging these gaps. This role is key to offering the expertise and tools to help women build confidence, prepare for the future, and achieve long-term financial security.

Why Financial Advisors Should Prioritize Women

1. Women Are a Growing Market Segment

By 2030, women could account for the majority of U.S. wealth, making them one of the fastest-growing client demographics. Ignoring this group means missing out on a massive opportunity for business growth.

2. Women Value Relationships

Women prioritize trust and communication when working with financial advisors. By building meaningful relationships and fostering open dialogue, you can create lifelong clients who are more likely to refer friends and family.

3. Women Invest Differently

Women are more likely to focus on long-term financial stability and socially responsible investments. Advisors who understand these preferences can provide tailored solutions that align with their goals.

How to Better Serve Women Clients

1. Listen Actively

Understanding your client’s unique goals and concerns is the cornerstone of building trust and providing effective financial planning for women. For many women, money management isn’t just about growing wealth. It’s about achieving long-term security, supporting loved ones, and aligning investments with personal values.

Actively listening means asking open-ended questions to uncover their priorities, such as:

- Are they focused on saving for retirement, funding education, or managing caregiving responsibilities?

- Do they have concerns about outliving their assets or navigating healthcare costs?

- Are they interested in socially responsible or sustainable investing?

By truly hearing and respecting their perspectives, you can create a personalized plan that reflects their values and mitigates their concerns. Since women are often less likely to feel confident about financial decisions, active listening is key. It fosters an environment where they feel supported, empowered, and more willing to engage in discussions about complex financial topics.

Tailoring your recommendations to prioritize financial stability over high-risk opportunities while still exploring growth strategies demonstrates your commitment to their success and helps build a lasting partnership.

2. Educate and Empower

Empowering women with knowledge builds confidence and fosters stronger client-advisor relationships. Providing resources like financial literacy workshops, interactive webinars, and personalized one-on-one consultations can help women feel more capable of managing their finances. Financial literacy not only equips women to make informed decisions but also instills a sense of control over their financial future.

When women feel empowered, they are more likely to actively participate in money management and trust their financial advisors, strengthening long-term partnerships. Offering education on topics such as retirement planning for women can be particularly valuable, as it addresses their unique needs and concerns.

Grow Your Portfolio: Connect with Women Investors

Ready to attract more women investors to your practice? Set up a free consultation with our experts to learn how tailored strategies and insights can help you engage this key audience and grow your business. Let’s get started.

3. Address Life Transitions

Major life changes—such as marriage, divorce, or the death of a spouse—are often pivotal moments when women seek financial advice. These transitions require not just financial expertise but also compassion and understanding. Financial advisors for women should be prepared to guide clients through these periods with tailored solutions that address immediate needs while planning for the long term.

Additionally, retirement planning for women is a critical area where advisors can make a lasting impact. By accounting for longer lifespans, healthcare costs, and potential caregiving responsibilities, advisors can help women secure a stable and sustainable future.

4. Focus on Holistic Planning

Women often approach financial planning with a focus on the bigger picture, weighing not just financial returns but also family needs, philanthropy, and legacy-building goals. To meet these expectations, advisors should offer services that integrate these broader considerations into actionable plans. By aligning financial strategies with their values—whether it’s supporting charitable causes, leaving a legacy for future generations, or ensuring family stability—advisors can provide a comprehensive and meaningful approach to wealth management that resonates with women’s priorities.

5. Offer Tailored Investing Tips for Women

Women investors are increasingly prioritizing investment strategies that reflect their unique goals and values. Advisors should focus on crafting personalized plans that balance risk and reward while incorporating preferences for social and environmental considerations. Women’s tendency to take a thoughtful, long-term approach to investing provides an opportunity to align portfolios with sustainable and socially conscious outcomes. By offering tailored guidance and demonstrating an understanding of their objectives, advisors can build trust and foster collaborative relationships with women clients.

The Business Case for Inclusion

Focusing on women as a distinct and valuable client segment is more than an ethical imperative—it’s a strategic advantage. As women’s financial influence grows, so does the opportunity for financial advisors and companies to align their services with the unique needs and preferences of this key demographic.

Additionally, research consistently shows that advisors who embrace diversity and inclusive financial planning achieve superior outcomes. These organizations benefit from stronger innovation, enhanced decision-making, and improved client satisfaction. Prioritizing women as a client group can yield specific business benefits, including:

- Strengthening Client Loyalty: Women often value long-term relationships with advisors who demonstrate empathy, understanding, and a genuine commitment to their goals. By tailoring services to meet their unique financial needs—such as addressing caregiving responsibilities, healthcare costs, and longevity concerns—you can build deeper, trust-based relationships that foster loyalty over time.

- Increasing Referrals: Women are natural connectors and are more likely than men to refer services they trust to friends, family, and colleagues. By creating a positive and personalized client experience, advisors can tap into this powerful referral network, significantly expanding their client base.

- Building a Reputation for Inclusive Practices: A reputation for being forward-thinking and inclusive can set advisors apart in an increasingly competitive industry. Clients today expect businesses to reflect their values, and inclusivity is a key driver of trust and engagement. By demonstrating a commitment to understanding and serving women, advisors can enhance their credibility, attract a broader audience, and position themselves as leaders in the market.

Moreover, focusing on women contributes to the broader financial ecosystem. Women’s investment preferences often emphasize sustainable, socially responsible outcomes, which can direct capital toward positive societal change. By helping women invest confidently and thoughtfully, advisors don’t just build their own businesses—they also contribute to creating a more equitable and prosperous financial future.

Conclusion

Women are redefining the financial landscape, and financial advisors for women who adapt to their needs will lead the way. By understanding the challenges women face, offering tailored solutions, and fostering strong relationships, you can position your practice as a trusted partner in their financial journeys.

Expand Your Reach: Engage and Empower Women Investors

Looking to grow your portfolio by connecting with women investors? Our proven financial seminar strategies help you engage this key audience with tailored insights and solutions. Click below to discover how seminars can transform your outreach and build lasting client relationships.