Listen to this Article

In today’s competitive financial landscape, client relationships are everything. For financial advisors, growth doesn’t just come from numbers; it comes from people. Building trust, exceeding expectations, and delivering an exceptional client experience can make the difference between a one-time interaction and a lifelong partnership.

But here’s the challenge: many advisors believe they know exactly what their clients want, while research consistently shows a disconnect between advisor assumptions and client expectations. The key to an extraordinary financial advisor client service model lies in closing that gap.

It’s not just about managing wealth. It’s about understanding people, anticipating needs, and creating meaningful experiences that inspire confidence and loyalty. Let’s break down how you can strengthen your client relationships, enhance your financial planning process, and build a truly client-centered business.

Step One: Know What Your Clients Really Want

This seems obvious—after all, you’ve built your career by helping clients navigate their financial futures. But are you sure you know what they truly value most?

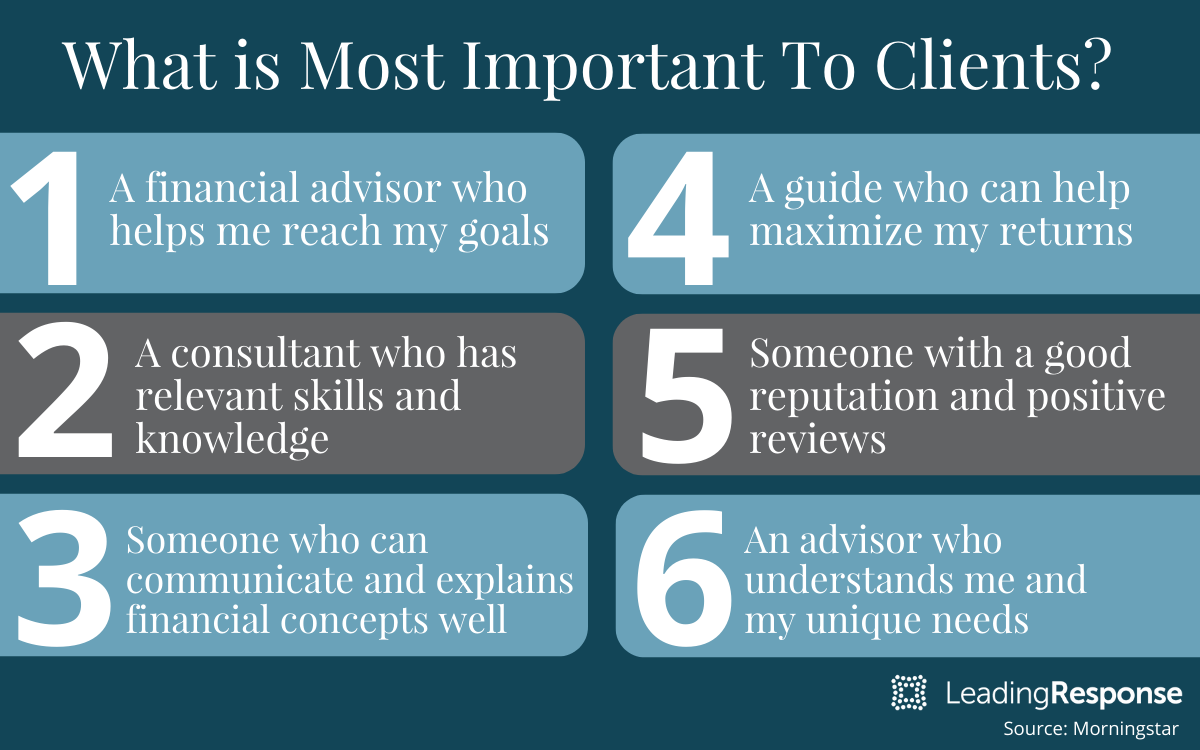

A report from Morningstar found notable differences between what advisors think clients prioritize and what clients actually say matters to them. Advisors tend to emphasize portfolio performance and returns, while clients are more focused on feeling heard, understood, and supported through life’s changes.

What this means for your client service model:

- Your expertise is valuable, but your empathy and communication are what make it memorable.

- Clients want guidance, not just numbers. They want to understand how each decision impacts their long-term goals.

- Transparency, proactive communication, and personal connection are as important as technical skill.

When you align your client experience with their values of security, trust, and clarity, you create stronger relationships that naturally lead to higher retention and referrals.

Building Trust That Lasts

Trust is the foundation of every great client relationship. Learn how to strengthen your credibility, improve communication, and create lasting loyalty with our step-by-step guide.

Step Two: Identify Your Ideal Clients

Not every prospect is a perfect fit. A truly effective financial advisor client service model begins with knowing exactly who you serve best.

Start by reviewing your existing client base. Who do you enjoy working with the most? Which clients value your guidance, trust your process, and refer others? These “ideal clients” share common traits; demographics, goals, communication preferences, and even values.

To clarify this further, build buyer personas. These are fictional profiles that represent your target clients. Include:

- Age, income, and occupation

- Financial goals and pain points

- Communication style

- Common objections or challenges

- Life stage and family situation

You can also create negative personas, the types of clients who don’t align with your services or expectations. Defining who you don’t want to work with is just as powerful as defining who you do.

By narrowing your focus, you’ll deliver a more personalized client experience. And one that speaks directly to your audience and demonstrates a deep understanding of their needs.

Step Three: Personalize Every Touchpoint

An extraordinary client experience doesn’t happen by accident. It’s the result of consistent attention to detail across every touchpoint, from the first ad a prospect sees to your ongoing follow-ups after onboarding.

Think of every interaction as part of your financial advisor client service model. Each one should reinforce trust and show clients that you understand their priorities.

Here’s how to do it:

- Build a plan together: Start by learning about your client’s goals, challenges, and values. Let them help shape the process so they feel invested.

- Be proactive, not reactive: Anticipate client questions and needs before they ask. Regular check-ins show care and attentiveness.

- Educate and empower: Help clients understand their financial plan. When they’re informed, they feel confident in your guidance.

- Innovate, don’t automate: Technology is great for efficiency, but personal connection should never be lost. Use automation for reminders or scheduling, not relationships.

Financial planning is a living process. Life changes, and so should your strategies. Continue to reassess, recalibrate, and communicate at every stage.

Why Personalization Matters

Every client is different—your approach should be too. Discover how personalized financial planning can elevate your client experience and set your firm apart from the competition.

Step Four: Establish a Niche and Build Expertise

Once you’ve defined your ideal clients, the next step is to determine how you can serve them better than anyone else. What niche can you own?

Maybe you specialize in retirement income planning, estate planning, or working with business owners. Perhaps you focus on women in transition, pre-retirees, or healthcare professionals. Whatever it is, double down on it.

Building a niche financial advisor client service model helps you:

- Create targeted messaging that resonates with your audience

- Strengthen your credibility through specialized knowledge

- Build trust faster because clients see you as the expert for their specific situation

Once you’ve defined your niche, amplify your credibility:

- Earn relevant certifications and continuing education

- Showcase testimonials and case studies from similar clients

- Host educational workshops and webinars tailored to your audience

- Publish blogs or videos that address common questions in your niche

When your expertise aligns with client needs, your financial advisor marketing becomes more authentic and effective—and your client-building efforts start compounding over time.

Step Five: Market Smarter with a Coordinated Plan

Your service model doesn’t exist in a vacuum. It should connect seamlessly with your marketing. How you attract prospects sets the tone for the experience they’ll expect as clients.

Marketing for financial advisors works best when it’s educational and value-driven. Think about strategies that highlight your expertise while offering real benefit to prospects:

- Educational workshops and financial seminars: Build credibility while providing useful financial insights.

- Webinars and virtual events: Reach a wider audience without geographic limits.

- Multichannel campaigns: Use a mix of digital ads, direct mail, and social media to reach prospects at multiple touchpoints.

- Follow-up nurture sequences: Keep prospects engaged with educational content until they’re ready to meet.

The key is consistency. A coordinated marketing plan for financial advisors ensures that every campaign reinforces your value and invites the right kind of clients to work with you.

Schedule Your 30-Minute Strategy Call

Ready to take your client experience to the next level? In just 30 minutes, we’ll help you identify gaps, strengthen your service model, and attract more ideal clients.

Step Six: Continuously Improve Your Client Experience

An exceptional financial advisor client service model is never “finished.” Client expectations evolve. Economic conditions shift. Your approach should adapt right alongside them.

Gather feedback regularly through surveys, post-meeting questionnaires, or informal check-ins. Ask clients what’s working and where you can improve. You might uncover small changes that have a big impact, such as simplifying reports, increasing communication frequency, or expanding service options.

Measure your performance in terms of both satisfaction and growth. Look beyond AUM to metrics like:

- Client retention and referral rates

- Meeting satisfaction scores

- Prospect-to-client conversion rates

- Time spent on client communication versus administration

Improving these numbers doesn’t just enhance the client experience, it builds long-term loyalty, stability, and sustainable business growth.

Go Beyond Expectations

Exceptional client service isn’t a one-time goal; it’s a mindset. The most successful financial advisors know that building trust, demonstrating empathy, and delivering consistent value are the true cornerstones of business growth.

When your clients feel understood, supported, and empowered, they become more than customers; they become advocates. And that’s the power of an extraordinary financial advisor client service model.

At LeadingResponse, we help financial advisors strengthen their client relationships and attract more motivated prospects through data-driven marketing and educational event strategies. Whether through live seminars, webinars, or multichannel marketing, we’ll help you connect with the right people, at the right time, in the right way.