Listen to this Article

In financial services, gender balance remains an ongoing challenge. Despite progress in securing leadership roles for women, the industry continues to be overwhelmingly male-dominated. This imbalance isn’t just a matter of diversity—it has a direct impact on business performance and growth.

Women represent a significant, yet often overlooked, market opportunity in financial advising. Financial advisors who fail to engage women are missing out on a crucial driver of potential ROI and growth.

Research shows that women are making more financial decisions and controlling significant wealth. This power is important for any advisor who wants to stay competitive and grow their business. Putting women first in your financial planning marketing strategy is not just the right choice. It is also a smart decision that can lead to long-term success in a changing market.

Why Gender Balance Matters

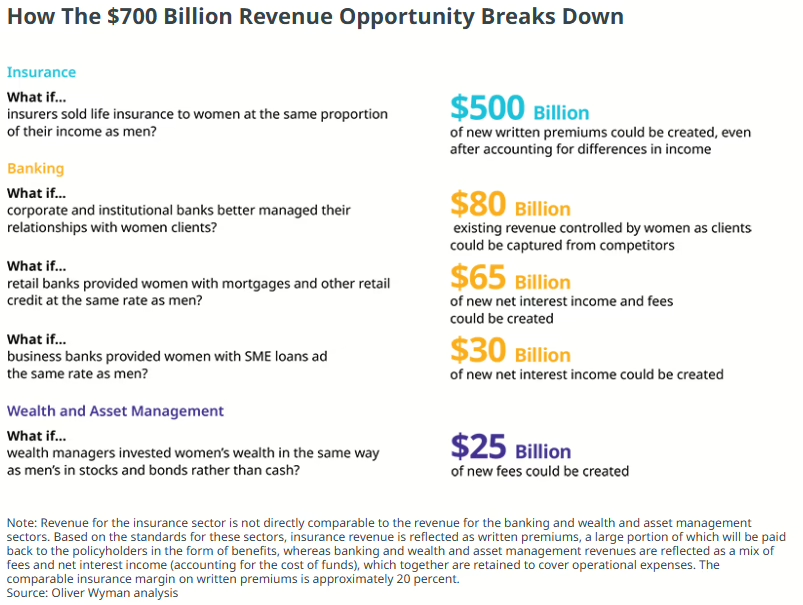

Women are one of the largest underserved groups in financial services. Despite their growing influence as decision-makers, many firms fail to meet their needs. Research by Oliver Wyman highlights a $700 billion global revenue opportunity in serving women better. For advisors, this is a chance to tap into a significant market.

Women represent a massive and growing financial powerhouse. They control an increasing share of global wealth, make critical household financial decisions, and excel in education and entrepreneurship. Yet, their unique financial needs are often overlooked.

Women face many challenges. These include longer life expectancies, taking breaks for caregiving, and unequal access to capital.

Addressing these gaps not only empowers women but also creates significant growth opportunities for financial advisors and institutions. Advisors who prioritize women will find a loyal, engaged clientele eager for tailored support.

Missed Opportunities in Serving Women

The financial industry often overlooks critical opportunities to serve women effectively. Women tend to invest more conservatively than men, favoring cash over stocks or bonds. Advisors who guide women toward diversified portfolios can unlock significant new revenue streams.

Female-led businesses also receive less funding than male-led ones. Providing equitable access to capital could add $30 billion in net interest income for financial institutions. Additionally, women buy life insurance less often than men.

By creating insurance products that meet women’s unique needs, companies could earn $500 billion in new premiums. This includes recognizing the value of unpaid domestic work. These gaps represent missed opportunities that advisors and firms can no longer afford to ignore.

Grow Your Portfolio: Connect with Women Investors

Ready to attract more women investors to your practice? Set up a free consultation with our experts to learn how tailored strategies and insights can help you engage this key audience and grow your business. Let’s get started.

Tailored Solutions for Women Clients

Advisors can stand out by designing services that address women’s distinct financial needs. For example, flexible financial planning can account for life events like caregiving breaks, which often disrupt long-term savings.

Offering goal-based advice connects investment strategies with the long-term goals many women care about. These goals include funding their children’s education and ensuring financial independence in retirement. Educational workshops focused on topics like retirement planning and money management for women also create welcoming spaces. These inclusive events empower women to take control of their financial futures and build trust in the advisory relationship.

Building Gender Balance Within Teams

Firms that prioritize gender balance in their teams gain a competitive edge. Diverse leadership leads to better decisions, creativity, and innovation. Inclusive workplaces also attract top talent, improve morale, and boost reputation.

But the benefits go deeper. Gender-balanced teams are uniquely positioned to connect with female clients.

Female advisors often understand the challenges and priorities women face, such as balancing caregiving responsibilities with long-term financial security. This insight enables them to build trust and foster strong client relationships. Additionally, women advisors serve as role models, inspiring other women to engage more confidently in financial planning.

Firms that promote and hire more women also reflect their client base, enhancing relatability and trust. As women see themselves represented within financial firms, they are more likely to engage and stay loyal. This representation not only enhances the client experience but also improves ROI. It does this by tapping into the full potential of the women’s market. A focus on gender balance isn’t just good ethics—it’s a business imperative.

Action Steps for Advisors

The financial industry is evolving. Meeting women’s financial needs is essential. Advisors who take steps like offering personalized strategies and inclusive marketing will capture growth opportunities.

To tap into this market, advisors should set up financial seminars and webinars focused on retirement planning for women. These events can address women’s unique financial challenges, such as longer life expectancies and the gender wage gap. By offering these services, advisors show they understand women’s needs and gain trust.

Advisors should also create website pages optimized for search terms like “financial advisors for women” or “retirement planning for women.” This helps them appear in search results when women are looking for financial guidance.

Social media is another great way to connect with women. Advisors can share tips, success stories, and helpful information about women’s financial challenges. By showing their commitment to women’s financial success, advisors can build a strong online presence.

Email marketing can also be segmented to target women specifically. Advisors can send emails that highlight their services as “financial advisors for women.” This ensures that the right message gets to the right audience, helping to build relationships with potential clients.

Focusing on women is not just a smart move for diversity—it’s a smart move for business growth. By using these strategies, financial advisors can stay competitive and grow their client base.

Expand Your Reach: Engage and Empower Women Investors

Looking to grow your portfolio by connecting with women investors? Our proven financial seminar strategies help you engage this key audience with tailored insights and solutions. Click below to discover how seminars can transform your outreach and build lasting client relationships.

The Takeaway

Serving women better isn’t just ethical—it’s essential for sustained business success. Women’s growing influence in wealth and financial decision-making presents an incredible opportunity for financial advisors and institutions.

Companies can grow significantly by addressing the specific needs of women. They can do this by offering special solutions, hosting inclusive financial seminars, and ensuring fair representation in teams. Gender-balanced teams connect more authentically with women clients, building trust and fostering loyalty.

The $700 billion chance to serve women better is not just a number. It is a guide for advisors who want to innovate and lead in a changing market. By prioritizing women in finance and inclusive financial planning, firms set the foundation for a stronger, more equitable future for all.