Listen to this Article

What prompts women to take control of their finances, especially later in life? Two common triggers are the death of a spouse and divorce. These life-altering events often leave women managing finances and navigating financial decisions they might not have handled before.

On average, women in the U.S. live about five years longer than men, while globally, the difference is closer to seven years. In America, men live to around 76 years, while women live to about 81. Additionally, the breakup of long-term marriages has contributed to a demographic shift toward women’s financial independence.

Although divorce rates have decreased over the past 20 years, the average age of divorce in 2022 was 46 for men and 44 for women. For Baby Boomers, divorce rates are increasing, with adults aged 55 to 64 experiencing a 46% divorce rate.

Other factors contributing to women assuming primary responsibility for finances include:

- Closing the wage gap between men and women.

- Caregiving responsibilities, as women are more likely to leave the workforce to raise children, care for aging parents, or both.

Financial advisors call this phenomenon “women in transition.” Whether taking control of household assets by choice or necessity, many women face challenges in meeting daily expenses while saving for the future. Women’s financial advice and tailored financial planning can make all the difference for this growing client base. If women aren’t part of your marketing campaigns or target audience, here’s why it’s time to change that.

Financial Planning for Women: An Overlooked Group

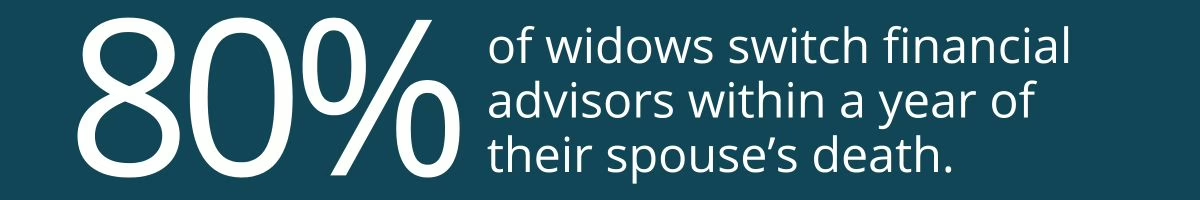

As more women take charge of their financial futures, advisory firms have a significant opportunity to address this underserved market. Here’s a startling fact: 80% of widows switch financial advisors within a year of their spouse’s death. Moreover, UBS reports that many financial advisors struggle to effectively support women as clients.

Why do women leave their financial advisors? Often, they feel overlooked, dismissed, or misunderstood. Many seek advisors who listen to their concerns, understand their unique needs, and provide tailored solutions for retirement planning for women and long-term financial success.

Advisory firms that embrace this shift and adapt their practices will differentiate themselves from those that fail to evolve. Welcoming women as clients, developing female-focused marketing strategies, and hiring women advisors can help capture this audience.

The Future Is Female

Take a moment to review your current client list. Does it include a significant number of single women? If not, you could be overlooking a growing client base. Consider these statistics:

- Women control more than a third of total U.S. household assets.

- The upcoming generational wealth transfer will disproportionately benefit women due to their longevity.

- Women are more likely than men to seek financial advice during major life transitions.

- Even with a concerted focus on retaining and attracting women clients, women simply want other things than their male counterparts.

Despite these opportunities, many firms fail to recognize the unique needs of female clients. Women are often more relationship-focused and less transaction-oriented than men, which requires a different approach from financial advisors.

Forbes highlights several key points about how women perceive financial advisors:

- 40% of women feel advisors treat them differently, often ignoring their input.

- 62% of women say their investment needs are unique, yet advisors fail to address them.

- Women are 2.5 times more likely than men to share their financial advisor experiences with others.

- Women base their decision to hire an advisor on the personal connection they feel, assuming expertise as a given.

- Many women feel fees are too high, largely due to a lack of understanding about fee structures.

The good news? Financial advisors who address these concerns can build trust, foster lasting relationships, and grow their client base. Women’s financial advice is not a one-size-fits-all approach—it requires empathy, education, and effective communication.

Grow Your Portfolio: Connect with Women Investors

Ready to attract more women investors to your practice? Set up a free consultation with our experts to learn how tailored strategies and insights can help you engage this key audience and grow your business. Let’s get started.

Strategies for Connecting With Women Clients

How can you connect with and convert more women into long-term clients? Here are some actionable strategies:

- Listen Actively: Women value advisors who listen more and talk less. Take the time to understand their goals, concerns, and unique financial situations.

- Tailor Your Advice: Provide personalized solutions for retirement planning for women and other financial goals. Avoid generic advice or assumptions.

- Educate and Empower: Many women appreciate learning about financial concepts to feel more confident in their decisions. Offer workshops, webinars, or one-on-one sessions focused on topics like budgeting, investing, and estate planning.

- Simplify Communication: Avoid jargon and clearly explain your recommendations. Make sure your clients fully understand your advice and fee structure.

- Build Trust: Women value advisors who act in their best interests. Be transparent, consistent, and reliable to foster trust over time.

- Offer Inclusive Financial Planning: Address the diverse needs of women at different life stages, from early career budgeting to retirement estate planning.

Women and Money: Steering Women Toward Financial Confidence

Hiring female financial professionals is one of the most effective ways to attract and retain women clients. Female advisors often bring unique perspectives and create a sense of comfort for women managing finances and seeking financial guidance.

However, only 15-20% of financial advisors are female. Misconceptions about the industry, such as it being overly math-focused or incompatible with family life, deter many women from pursuing this career path. Financial services firms must do more to promote the industry as a flexible and rewarding option for women.

Wealth management and asset management often provide greater opportunities for work-life balance than sectors like investment banking. Highlighting these benefits can help attract more women to the profession, ultimately diversifying your team and enhancing your ability to serve female clients.

How LeadingResponse Helps Financial Advisors Connect With Women

Connecting with women clients requires more than just a strategy—it requires the right tools and resources. At LeadingResponse, we specialize in helping financial advisors reach their target audience through customized marketing solutions. Whether you’re hosting financial seminars, educational workshops, and ongoing webinars, our platform enables you to engage with women in meaningful ways.

Here’s how we can help:

- Targeted Marketing: Reach women prospects at the right time with campaigns tailored to their needs.

- Educational Events: Host events focused on women’s financial advice, empowering them to take control of their financial futures.

- Expert Guidance: Benefit from our years of experience helping financial advisors grow their practices through effective marketing strategies.

By partnering with LeadingResponse, you can position your firm as a trusted resource for women and money management while growing your client base.

The Bottom Line

Women are increasingly managing household finances and seeking financial advisors who understand their unique needs. If your business isn’t actively targeting women clients, you’re missing a significant opportunity for growth.

By adapting your approach, hiring diverse talent, and leveraging tools like financial seminars and educational workshops, you can better serve women at every stage of life. Let LeadingResponse help you connect with this growing audience and build lasting client relationships.

Ready to expand your reach? Contact us today to create a personalized plan for growing your business and connecting with women clients.