Listen to this Article

In today’s business world, data drives nearly every decision. With diverse channels available through multichannel marketing, knowing where to allocate resources is essential for growth, and one of the most effective ways to measure the success of these choices is with Return on Investment (ROI). But what exactly is ROI, why should it matter to your business, and how can you calculate ROI to maximize your potential?

This blog explores everything you need to know about return on investment ROI. We’ll cover how to calculate it, why it’s critical to track, and how you can apply ROI across various aspects of your business—including multichannel marketing—to make informed, profitable choices.

What is ROI?

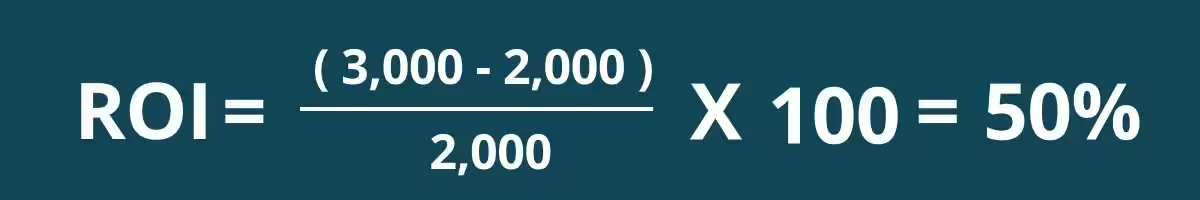

Return on Investment, or ROI, is a measurement used to evaluate the profitability of an investment compared to its cost. It answers a straightforward question: “Did this investment pay off?” The ROI formula is easy to understand:

Here’s a breakdown:

- Net Profit: The amount you earn after subtracting all expenses associated with an investment.

- Investment Cost: The total amount you invested.

By dividing net profit by investment cost and multiplying by 100, you get the ROI percentage, which reflects how efficiently your money was spent. A positive ROI means that the return was more than the investment cost, while a negative ROI indicates that the investment lost money.

For example, if a business spends $2,000 on an ad campaign and it generates $3,000 in sales, the ROI would be:

This means the campaign yielded a 50% return on the initial investment. Calculating ROI can be simple, but it can also become complex when applying it to different contexts or industries.

Why is ROI Important?

Tracking ROI is about more than just numbers; it’s about making strategic data-based decisions based on actual performance data. Here are four major reasons why ROI calculations are invaluable for any business:

- Evaluates Profitability: One of the biggest advantages of ROI is that it measures profitability. It provides a clear indicator of whether a project or campaign was worth the investment. High ROI means strong profitability; low or negative ROI indicates resources might be better invested elsewhere.

- Supports Data-Driven Decisions: In today’s competitive environment, data-driven decisions have become essential. ROI data helps business owners and managers understand which initiatives yield the best returns. By comparing ROI across campaigns or projects, companies can make informed choices that contribute directly to their growth.

- Optimizes Budget Allocation: ROI is a powerful tool for determining where to allocate your budget. For instance, if a seminar marketing campaign yields a higher ROI than a social media campaign, this insight enables you to adjust spending toward the channel with greater returns.

- Forecasts Future Spending and Justifies Costs: ROI helps forecast future budgets and justify spending to stakeholders. By consistently tracking ROI, businesses can identify long-term trends, measure the success of various initiatives, and justify investments to clients or investors with concrete evidence.

Tracking ROI should be a priority for everyone from small business owners to large corporations, as it provides the foundation for more effective planning and budgeting.

How to Calculate ROI: A Step-by-Step Guide

At its most basic, the ROI calculation is a simple formula. However, depending on the complexity of the project or the timeline involved, calculating ROI can include adjustments or require additional data points. Here’s a step-by-step approach:

- Determine the Investment Cost: Identify all costs related to the investment. This may include production, distribution, labor, marketing, and any other expenses directly tied to the project.

- Calculate Net Profit: Subtract the total expenses from the revenue generated by the investment. For example, if a marketing campaign generated $5,000 in sales and cost $2,000, your net profit would be $3,000.

- Apply the ROI Formula: Once you have the figures, plug them into the formula. This will give you the ROI percentage, which represents the profitability of the investment.

Real-World Examples and Variations in ROI Calculations

Not all ROI calculations are straightforward. Some situations require adjustments, especially when comparing projects with different timelines or when factoring in other metrics like customer acquisition cost or customer lifetime value.

- Long-Term Investments: For financial advisors and Medicare agents, long-term investments may include multi-year client acquisition efforts or ongoing education-based marketing campaigns. In these cases, calculating a time-adjusted ROI is essential. This approach accounts for the value of money over time, using discounting to adjust future returns to present value.

- Customer Acquisition Cost (CAC): Tracking ROI also involves measuring the customer acquisition cost (CAC). This metric assesses the cost-per-acquisition (CPA), helping you understand the expense of acquiring each new client and how that investment contributes to growth over time.

- Client Lifetime Value (CLV): CLV is particularly valuable in advisory and Medicare services, where clients may require ongoing support or additional products. This metric allows you to evaluate the ROI of acquiring a client based on their entire lifetime value with your practice, not just the initial engagement or product sale.

Tracking ROI for Business Success

ROI is not a one-and-done calculation; it requires regular tracking to provide an accurate picture of a project’s performance. By consistently monitoring ROI, you can ensure that your initiatives align with long-term business goals.

However, interpreting ROI requires caution. Here are some key considerations:

- Short-Term vs. Long-Term Gains: Not all initiatives yield instant ROI. For example, brand awareness campaigns often don’t show immediate profit but can increase brand value over time, eventually improving ROI across future campaigns.

- Set Realistic Benchmarks: Industry standards can provide insight into what is considered a “good” ROI for specific types of investments. Benchmarks can vary by industry, so researching average ROI in your field can help set realistic expectations.

- Don’t Ignore the Bigger Picture: ROI is an excellent way to measure investment success, but it should be interpreted within the broader context of business objectives. For example, a slightly lower ROI on a brand-building initiative might still add value to the company by increasing customer loyalty and brand equity.

Tools and Best Practices for Calculating and Tracking ROI

Today, various tools make tracking and calculating ROI much easier and more accurate. Here are some of the most commonly used tools and best practices:

- Google Analytics: Google Analytics is an effective tool for tracking website performance, conversions, and even the ROI of digital marketing campaigns. By setting up specific goals and tracking website activity, you can calculate the ROI of website and ad campaigns.

- Customer Relationship Management (CRM) Systems: CRM systems are valuable for tracking ROI related to customer relationships. They enable businesses to measure the revenue generated from each customer segment and evaluate the cost-effectiveness of customer engagement strategies.

- Marketing Automation Platforms: Marketing automation platforms, such as HubSpot or Salesforce, offer tools for tracking ROI across channels like email marketing, social media, and paid ads. These tools are helpful for identifying which campaigns are most profitable and adjusting budgets accordingly.

- Benchmarking Tools: Industry benchmarks and business intelligence tools provide insights into average ROI rates by industry. Using these tools can help you gauge your performance compared to competitors and adjust strategies for higher ROI.

- Hub (LeadingResponse’s Client Portal): Hub is a client portal that provides detailed insights into event performance and ROI, allowing LeadingResponse clients to monitor engagement metrics, track results, and optimize strategies for future campaigns based on real data.

Get the Data You Need to Grow Your Business

Hub is the ideal platform for you to plan and monitor campaigns and dig deep into performance analytics in real-time and access to more data in less time.

Tips for Effective ROI Tracking

To get the most accurate and actionable data, here are a few best practices for tracking ROI:

- Define Clear Objectives: Before starting any project or campaign, define what a successful ROI will look like. Clear goals help keep your efforts focused and measurable.

- Set a Timeline for Tracking: Decide how often to review your ROI. Monthly, quarterly, or annual reviews can provide a clear picture of performance over time and identify areas for improvement.

- Compare Across Similar Projects: To ensure fairness in comparison, evaluate ROI across projects with similar goals and timelines. This approach prevents misinterpretation of data and provides more meaningful insights.

Conclusion

Return on Investment (ROI) is an indispensable metric for businesses looking to assess the value of their investments. From evaluating the success of marketing campaigns to making strategic decisions about resource allocation, ROI calculations empower companies to make data-driven choices that boost profitability.

Tracking and interpreting ROI consistently not only helps you see what’s working but also provides insights into where to improve. In today’s competitive market, the ability to calculate ROI effectively can make the difference between wasted resources and sustained growth. With the right tools, clear objectives, and consistent monitoring, ROI becomes not just a calculation but a guide for ongoing business success.

Whether you’re launching a new product, running an ad campaign, or planning a long-term project, keeping ROI in mind ensures your efforts contribute to a profitable and growth-oriented future.