Listen to this Article

If you’ve ever wondered whether becoming a financial advisor is worth it, you’re not alone. The field of financial advising continues to attract professionals from all walks of life who are analytical, empathetic, and motivated to help others achieve financial freedom. But one of the most common questions remains: Is financial advising profitable?

The short answer: yes, it can be. But profitability depends heavily on effort, strategy, and your ability to build relationships and market yourself effectively. Success in this career doesn’t come from a paycheck; it’s earned through growing your client base, managing relationships, and developing a clear marketing strategy that drives new opportunities.

Let’s break down how financial advisors make money, what factors influence their income potential, and how marketing plays a critical role in long-term financial advisor career growth.

How Financial Advisors Make Money

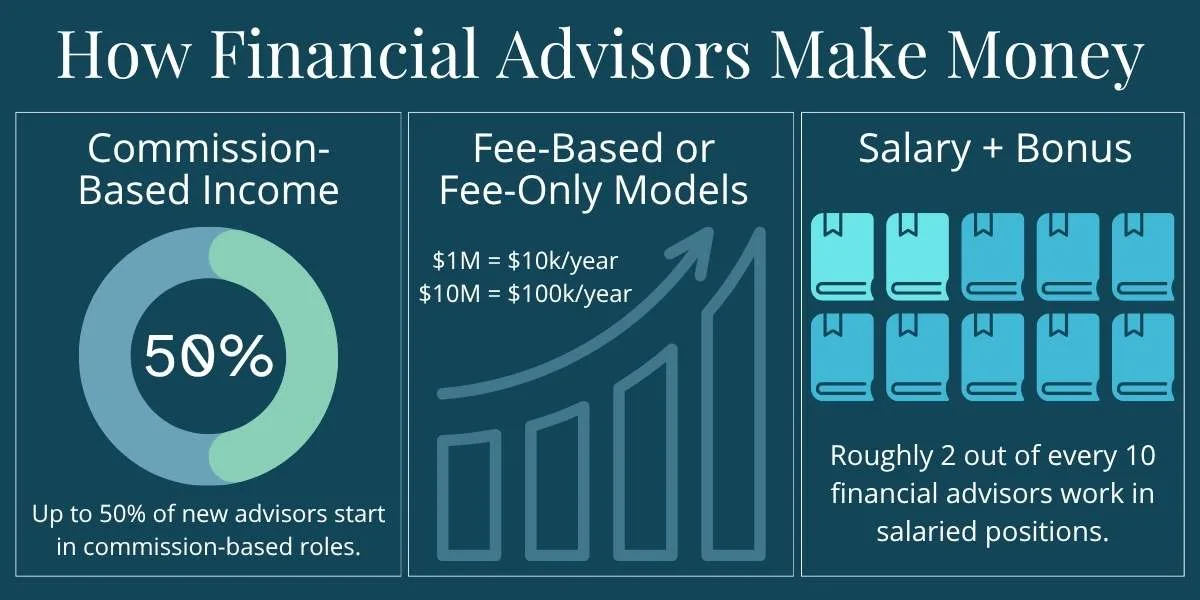

Financial advisors have several ways to earn income, depending on their business model and client base. The most common structures include:

- Commission-Based Income

Some advisors earn a commission from the financial products they sell, such as insurance policies, mutual funds, or annuities. This model rewards sales volume, but it also comes with stricter compliance standards and may require balancing sales goals with the client’s best interests. - Fee-Based or Fee-Only Models

Fee-based advisors typically earn a percentage of the client’s assets under management (AUM). For example, an advisor who manages $10 million in assets might charge a 1% fee, generating $100,000 in annual revenue. Fee-only advisors, on the other hand, charge flat fees or hourly rates for services, focusing on transparency and long-term trust. - Salary Plus Bonus

In some firms or institutions, financial advisors may receive a base salary supplemented by performance bonuses. This model provides more income stability, though growth potential can be capped compared to independent advisors.

Each structure has its pros and cons. The key is aligning your income model with your career goals, personality, and desired client experience.

Financial Advisor Income Potential

So, how much can a financial advisor make? According to industry data, the median annual income for financial advisors in the U.S. hovers around $102,000, but that number varies widely based on experience, business model, and client portfolio.

Top-performing advisors, especially those managing high-net-worth clients or running established firms, can earn $200,000 to $500,000+ annually. In contrast, new advisors often start at lower earnings as they build their client base.

Your income potential as a financial advisor depends on:

- Experience and tenure: Advisors typically see income increase substantially after their third or fourth year as their client base grows.

- Client type: High-net-worth clients or business owners tend to bring higher AUM and recurring revenue.

- Marketing and lead generation: Advisors who consistently attract qualified prospects through financial planning seminars, workshops, or digital outreach see faster growth.

- Retention and referrals: Satisfied clients are the foundation for long-term profitability. Word of mouth and referrals often drive the highest-quality leads.

While the numbers may vary, one thing is clear: those who treat their advisory practice like a business, and market it that way, see the greatest financial and professional rewards.

Ready to Launch Your Career?

Starting your business the right way can make all the difference. Learn how to attract clients, build credibility, and set a foundation for lasting success.

Financial Advisor Career Growth

Beyond income, financial advising offers tremendous career growth opportunities. Advisors can choose to remain independent, join a larger firm, specialize in a niche, or even transition into leadership roles such as branch manager or partner.

Here’s what career growth often looks like in this field:

- Year 1–3: Building your book of business. Expect heavy prospecting, long hours, and a steep learning curve. Marketing, networking, and building trust with early clients are critical during this stage. It’s also the phase where many new advisors struggle, not because they lack skill or drive, but because they underestimate how much consistent outreach and relationship-building it takes to establish a solid client base. Those who commit to learning effective marketing strategies and staying persistent through this stage often lay the foundation for long-term success.

- Year 4–7: Establishing stability and systems. Advisors in this stage typically develop a consistent client base, streamline their processes, and begin focusing on retention and referrals.

- Year 8 and beyond: Scaling and specialization. Successful advisors often find a niche, such as retirement planning, estate planning, or tax optimization, and position themselves as experts in that area. This is where brand reputation and marketing strategy truly amplify results.

Financial advisor career growth doesn’t happen by accident. It’s built on relationships, consistent marketing, and ongoing education. Advisors who invest time in learning new tools, expanding service offerings, and using data-driven marketing insights tend to grow faster and stay ahead of competitors.

Why Financial Advisor Marketing Matters

You can be the most knowledgeable financial advisor in your city, but without a steady stream of qualified leads, your income will plateau. Marketing bridges the gap between expertise and opportunity.

Here’s how effective financial advisor marketing drives profitability and career growth:

- Builds Awareness and Credibility

Educational marketing, like workshops, webinars, and community events, positions advisors as trusted experts rather than salespeople. When prospects see you as a resource, not a pitch, they’re more likely to engage. - Expands Reach Through Multiple Channels

Relying on referrals alone limits growth. Combining in-person events with digital ads, email campaigns, and retargeting expands visibility and keeps your brand top-of-mind with qualified audiences. - Improves Client Retention

Marketing doesn’t stop once a client signs on. Consistent communication through newsletters, educational updates, or financial check-ins builds loyalty and long-term trust. - Provides Data to Drive Smarter Decisions

Modern marketing tools track engagement and conversion rates, helping advisors understand what works and where to invest more. The result: higher ROI and more predictable growth.

The Path to a Profitable Practice

Becoming a successful financial advisor isn’t just about numbers; it’s about understanding people. Profitability follows when you can blend financial expertise with empathy, strategy, and consistent outreach.

Here are three takeaways for advisors looking to maximize income potential and accelerate career growth:

- Invest in Marketing Early – Waiting until you “need” new clients is too late. Build your brand visibility year-round through educational events and digital channels.

- Focus on Client Experience – The best marketing tool is a satisfied client. Personalize your approach and make clients feel valued at every step.

- Measure and Adjust – Track what works. Whether it’s seminar attendance, webinar engagement, or ad conversions, data helps refine your strategy and scale your results.

Take Your Business to the Next Level

Already established but not seeing the results you want? Our data-driven marketing solutions help advisors expand their reach, increase appointments, and accelerate career growth.

Final Thoughts: Is Financial Advising Worth It?

Yes, financial advising can be an incredibly profitable and fulfilling career. But profitability doesn’t happen automatically. It takes dedication, strategic marketing, and an unwavering focus on client relationships.

The most successful advisors don’t just sell, they educate, connect, and nurture trust. They use data-driven marketing, host educational workshops, and invest in consistent outreach to attract and retain loyal clients.

If you’re serious about financial advisor career growth, it’s time to take a strategic approach. Build your visibility, refine your client experience, and use proven marketing systems that turn prospects into lifelong clients.